Dubai, UAE – October 18, 2025 – GOTD Blockchain Labs FZCO, a trailblazing force in the global financial ecosystem, proudly announces the launch of its groundbreaking P2P Netting Protocol. With over eight years of hands-on expertise in import-export operations and a robust daily transaction volume exceeding $3 million across more than 20 jurisdictions worldwide, GOTD Blockchain Labs FZCO has established itself as a trusted leader in cross-border commerce. This newly launched, fully licensed Distributed Ledger Technology (DLT) solution, intelligently powered by advanced machine learning algorithms, introduces innovative features such as tokenized escrow and automated netting mechanisms. These cutting-edge tools are meticulously designed to eradicate longstanding pain points in global finance, ushering in an era of unprecedented security, operational efficiency, and dramatic cost reductions for cross-border transactions. In an industry ripe for transformation, GOTD Global is poised to redefine how businesses conduct international trade, fostering trust and unlocking untapped economic potential on a massive scale.

Addressing Critical Market Challenges

The global financial landscape today is undeniably fragmented, presenting businesses with a formidable array of obstacles that stifle growth and innovation. At the forefront is a pervasive lack of trust, fueled by rampant scams, sophisticated fraud schemes, and the infamous “who sends first” dilemma that plagues crypto-to-fiat transactions. These issues frequently deter potential partnerships, leaving companies isolated and opportunities squandered. Compounding this is limited market access, where geographic barriers, regulatory complexities, and inherent risks prevent operators from capitalizing on lucrative international prospects that could otherwise drive exponential revenue growth. High costs further exacerbate the problem, with traditional fees ranging from 2-5% rendering countless transactions economically unviable—especially in emerging markets where access to legacy systems like SWIFT remains woefully inadequate, leaving billions in potential trade value on the table. Finally, operational inefficiency arises from the manual coordination of complex multi-party deals, which inevitably leads to costly delays, human errors, and missed deadlines that erode profitability and customer satisfaction.

GOTD Global confronts these entrenched challenges with surgical precision through its revolutionary P2P Netting Protocol. By slashing transaction fees to an industry-leading flat rate of just 0.1%, the platform makes even the smallest cross-border deals profitable, democratizing access to global markets for businesses of all sizes. Moreover, it guarantees zero fraud exposure through a sophisticated blend of tokenized escrow services and secure off-chain collateral verification, eliminating the trust gap that has long hindered international commerce. This isn’t mere theory—it’s battle-tested technology ready to transform real-world operations. To witness the protocol in action and understand its seamless workflow, we invite you to view the concise yet comprehensive GOTD Global Overview video, which breaks down the process in under two minutes and showcases tangible benefits for users worldwide.

Tailored for B2B Operators Worldwide

At its core, GOTD is precision-engineered for B2B operators, including financial hubs, exchange services, and fintech companies tasked with managing high-volume international liquidity flows. The platform’s strategic focus spans a diverse array of high-potential regions, ensuring comprehensive coverage of both emerging powerhouses and established financial centers. In emerging markets, GOTD targets dynamic growth areas across Africa—such as Nigeria, Kenya, South Africa, Ghana, and Egypt—where rapid urbanization and digital adoption are creating explosive demand for efficient payment solutions. Central Asia’s burgeoning economies, including Uzbekistan, Kazakhstan, Kyrgyzstan, and Tajikistan, benefit from the protocol’s ability to bridge remote corridors. Latin America’s vibrant markets in Brazil, Argentina, Mexico, Colombia, Chile, and Peru gain seamless connectivity, while Southeast Asia’s tigers—Indonesia, Myanmar, Vietnam, Thailand, the Philippines, and Malaysia—leverage GOTD for faster regional trade. South Asia’s giants like India, Pakistan, and Bangladesh, alongside mainland China, round out this robust emerging-market footprint.

For developed hubs, GOTD delivers enterprise-grade reliability to Asia-Pacific leaders including Singapore, Hong Kong, Japan, South Korea, and Australia; Europe’s financial powerhouses such as the United Kingdom, Germany, France, the Netherlands, Switzerland, Poland, the Czech Republic, Spain, Italy, Portugal, Greece, and Cyprus; the Middle East’s innovation epicenters like the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, Oman, Kuwait, Jordan, and Lebanon; Turkey, serving as a vital bridge connecting Europe, the Middle East, and Asia; and North America’s anchors, the United States and Canada. This global reach isn’t incidental—it’s the result of meticulous market analysis ensuring GOTD aligns perfectly with the needs of operators in these corridors.

What sets GOTD apart is its proprietary machine-learning engine, which intelligently automates the matching of counter-flows and consolidates disparate transactions into streamlined netting processes. This automation minimizes idle capital, accelerates settlement times from days to minutes, and maximizes liquidity utilization. In stark contrast to outdated traditional systems like SWIFT, which suffer from high latency and opacity, or competitors such as Ripple and Stellar that primarily focus on bilateral transfers, GOTD excels in optimizing complex multilateral deals. Users gain access to real-time, transparent liquidity dashboards for unparalleled visibility and instant counterparty verification to mitigate risks proactively. The result? A resilient network that scales effortlessly with user demand, empowering B2B operators to thrive in today’s hyper-connected economy.

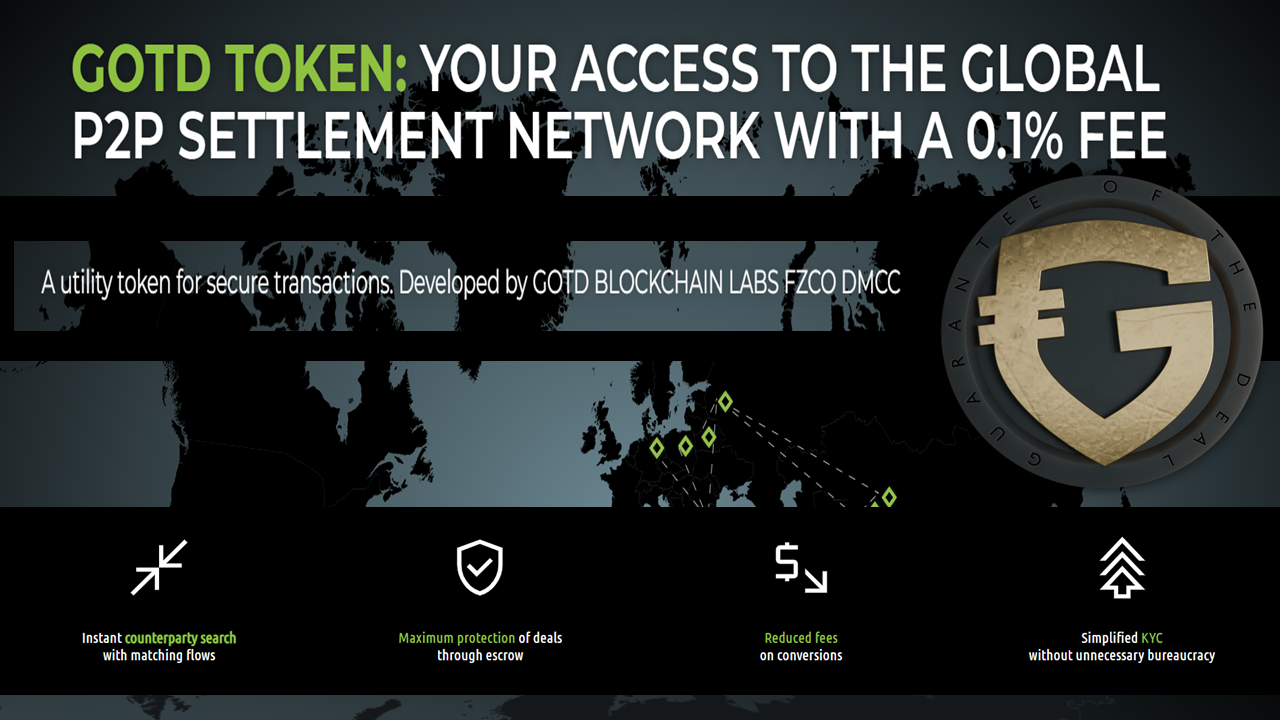

GOTD Token: The Backbone of Trust and Efficiency

Powering this transformative ecosystem is the GOTD utility token, a multifaceted digital asset that serves as the unbreakable backbone of trust, efficiency, and sustainable growth. As collateral for secure escrow arrangements, it ensures every transaction is fully protected; as a staking mechanism for liquidity confirmation, it incentivizes network participation; and as a growth engine tied directly to platform expansion, it rewards long-term commitment. The tokenomics are transparently designed for stability and value accrual: a total supply capped at 1 billion tokens, with 800 million already in circulation to fuel immediate adoption; a current SAFT price of $0.50 per GOTD, exclusively available to accredited investors; and a post-TGE price set at $1.00 per GOTD, reflecting confident market positioning.

Unlike speculative tokens divorced from real utility, the GOTD token’s value is intrinsically anchored to the network’s tangible, real-world performance, targeting an colossal $40 trillion+ market opportunity across emerging-market payment corridors. This direct linkage to off-chain economics—actual liquidity flows, operational volumes, and verified trade data—creates a self-reinforcing value proposition, where network growth naturally drives token appreciation. For accredited investors seeking exposure to this high-potential infrastructure play, early access via SAFT is available at myGOTD.com. This represents a rare opportunity to join an early-stage project boasting a fully functional MVP that’s already supporting genuine business expansion and generating measurable results.

Regulatory Strength and Future Plans

GOTD’s unwavering commitment to compliance underscores its enterprise readiness. Fully licensed under the prestigious DMCC for DLT services and in complete alignment with IFZA regulations, the platform delivers ironclad legal backing, instilling confidence among users, partners, and regulators alike. This regulatory fortress enables seamless operations across jurisdictions, mitigating compliance risks that plague lesser solutions.

Looking ahead, GOTD’s ambitious roadmap charts a clear path to dominance: In Q4 2025, the MVP launches on Devnet, initiating closed testing with over 50 premier hubs to refine and validate performance under real conditions. Q1-Q2 2026 brings the highly anticipated Mainnet rollout and Token Generation Event (TGE), marking full operational maturity. By Q3 2026 through 2027, GOTD scales aggressively to over 1,000 integrated hubs, achieving $100 million+ in daily transaction volume, and securing listings on top-tier centralized exchanges (CEX) for enhanced liquidity and global accessibility.

Beyond the core roadmap, GOTD is set to pioneer expansions into multi-currency clearing for frictionless handling of diverse fiat pairs; tokenized settlements to accelerate asset transfers; and robust API integrations that empower broader fintech adoption, allowing seamless embedding into existing enterprise systems. These innovations position GOTD not just as a payment rail, but as the foundational infrastructure for the next generation of global finance.

Join the Revolution – Closed Testing Starts Soon

The revolution is here, and participation begins November 1, 2025, with exclusive closed testing. Liquidity providers and hubs worldwide are urged to apply immediately for priority access, where you can actively contribute to development, shape the platform’s evolution, and secure your role as a regional representative—complete with exclusive perks like revenue shares, priority support, and branding opportunities. Early participants will receive eGOTD tokens at the preferential rate of $0.50, providing an immediate stake in this high-growth venture.

About GOTD Global

GOTD Blockchain Labs FZCO is a Dubai-based innovator in blockchain-enabled financial infrastructure, specializing in secure, efficient cross-border settlements for B2B operators worldwide. With proven expertise and a vision for global impact, GOTD is building the backbone of tomorrow’s trade economy.

Ready to optimize your operations, eliminate fraud risks, and unlock global scale? Don’t wait; register today at GOTD.global and Join the Network to Start Testing, securing your spot in the future of finance.

Media Contact:

Sergei Martinez

GOTD Tradesync FZCO

Email: info@gotd.global

Websites: mygotd.com (Token) | gotd.global (Platform)

Video: GOTD Global Overview

Disclaimer:

This press release is provided by GOTD Global for informational purposes only and does not constitute financial advice, an investment offer, or endorsement. GOTD Global is solely responsible for the content’s accuracy. Readers should perform their own due diligence and consult a licensed advisor before any decisions. Participation in SAFT is limited to accredited investors. Token generation and listings depend on regulatory approvals.